Dark clouds are gathering over the Greek economy, according to the Morgan Stanley, which with its new information note sounds the alarm, because of the high inflation which is recorded, of investment gap, her political instability but also her extension received by investment grade recovery.

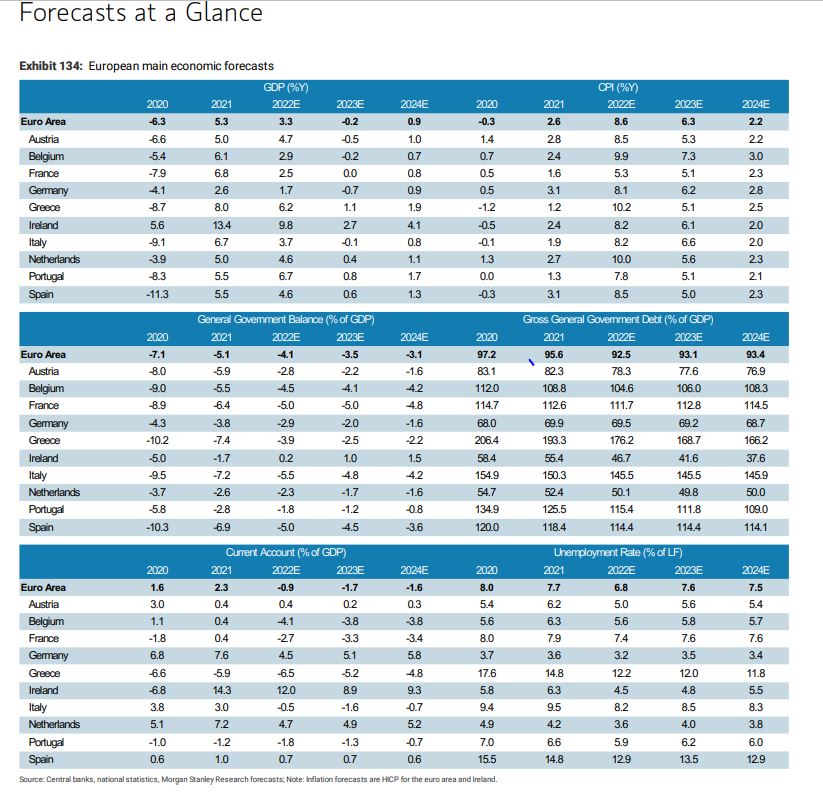

In particular, according to the American bank, it expects Greece to grow by 6.2% in 2022, just 1.1% in 2023 and 1.9% in 2024.

At the same time, Mr inflation expected to jump to 10.2% in 2022 and 5.1% in 2023…

As far as the deficitwill be -3.9% in 2022, -2.5% in 2023 and -2.2% in 2024, while on a downward trajectory is debt (-176.2% in 2022, -168.7% in 2023 and 166.2% in 2024)

Also, the unemployment it will be 12.2% in 2022, 12% in 2023 and 11.8% in 2024.

Durability: Morgan Stanley expects a significant slowdown in economic activity during the winter due to high inflation.

But, in the end, Greece will be able to avoid a technical recession, thanks to the support that comes from a fairly well-targeted fiscal policy and the implementation of the RRF.

One of the major risks stems from Greece’s heavy reliance on Tourism – around 15% of its GDP.

Also, high inflation will likely lead to a reduction in elastic consumer spending, which will ultimately negatively affect tourism flows and thus Greece’s GDP.

In relation to the agent “Political instability”as reported by the American house, Greece was expected to go to the polls in the summer of 2023, but a political scandal, which is currently unfolding, may cause early elections.

Prime Minister Mitsotakis has so far rejected the possibility of his resignation, so the main scenario remains the continuation of the current government until the end of its term.

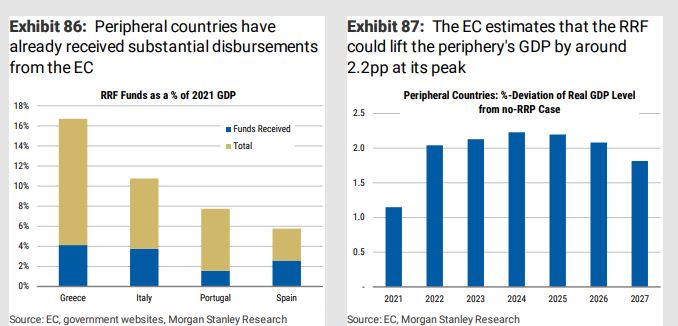

Investment gap: Greece has suffered for years from under-investment since the global financial crisis, but the combination of high FDI (foreign direct investment) and RRF could help to bridge, to some extent, the investment gap with other EU countries.

Greece’s Recovery Plan, amounting to €30.5 billion (about 16% of 2019 GDP) and includes up to 106 investment projects related to infrastructure, Energy, electricity and digitalization, SMEs, but also 67 reforms that address many of the country’s problems.

Overall, the RRF could increase GDP by up to 6.9% by 2026, based on Bank of Greece estimates.

Credit rating: The road to investment grade recovery is long.

Greece’s credit rating is still below investment grade, but gradual improvements have been possible thanks to stronger economic figures and visible progress made by Greek banks in reducing their NPLs.

However, macroeconomic uncertainty led rating agencies to take a wait-and-see approach in their latest ratings around September/October.

Based on the latest comments from Fitch, Moody’s, S&P and DBRS, we believe that the energy crisis, the slowdown in economic activity and possibly required additional fiscal spending will likely delay Greece’s return to investment grade until at least 2024.

Debt/GDP on a downward trajectory: In this case, the evolution of Greek debt is not a cause for concern: About 75% of the country’s debt is held by the official sector, while the average maturity is 20.6 years if it includes official debt (ESFS and ESM loans) and nine years for outstanding debt instruments.

All these factors contribute to a very low average interest rate, the lowest of all countries in the euro area periphery, and given the structure of Greek debt, it will likely remain contained for a very long time.

www.bankingnews.gr